CalPERS, CalSTRS and other government pensions

No ceasefire in CalPERS war with San Bernardino

CalPERS made two court filings last month after the San Bernardino city

council approved a confidential draft of a plan to exit bankruptcy, as if

stepping up opposition in reaction to something in the plan.

But a spokeswoman for the big pension fund said the filings are unrelated to

the cityfs plan or gterm sheet.h As directed by a federal bankruptcy judge, the

plan is a starting point for closed-door mediation and has not been revealed to

the public.

The two CalPERS court filings continue an all-out legal battle triggered

when San Bernardino did the unprecedented: skipped employer pension

contributions last fiscal year, running up a tab of about $17 million, before

resuming payments in July.

The giant California Public Employees Retirement System wants its more than

3,000 local government employers to know that withholding pension contributions

is a no-go zone, not an option if they struggle financially.

San Bernardino, in danger of not making payroll, made an emergency

bankruptcy filing in August last year, staying debt collection. The city stopped

about $30 million in various payments, roughly half owed to CalPERS.

In response, CalPERS became the lone opponent of San Bernardinofs

eligibility for bankruptcy, unsuccessfully attempted to sue the city in state

court, and accused the city of creating a crisis and withholding key financial

information.

gI donft believe anyone in this courtroom seriously thought the city was not

insolvent,h U.S. Bankruptcy Judge Meredith Jury said while ruling San Bernardino

eligible for bankruptcy last August.

Two weeks after the San Bernardino city council approved the term sheet last

month CalPERS asked to

appeal the eligibility ruling: gNever has a bankruptcy court set such a

low bar for a municipal debtor to enter the doors of a bankruptcy court.h

And a week after that, CalPERS filed

a brief in support of an appeal by the state Department of Finance and

state Controller of the judgefs ruling on $15 million in city tax revenue.

The judge blocked a state attempt to withhold $15 million in sales and

property taxes. San Bernardino had not returned a similar amount of unspent

housing funds after the state shut down local redevelopment agencies.

gIfm just amazed at their decision to fight the city on land and sea and

air, at every level,h Mayor Patrick Morris told the San Bernardino Sun after

CalPERS filed the brief in support of the state appeal.

Without the $15 million, he said, gWe canft pay our employees. It sinks the

ship — we canft pay CalPERS. Itfs legal idiocy.h

Judge Jury expressed similar puzzlement in August about CalPERS opposition

to bankruptcy eligibility, saying the apparent alternative is dissolving the

city. gHow does that help CalPERS if the employees arenft paid?h she said.

As deep-pocketed CalPERS tries to drive home the point that there is a stiff

price to pay for skipping pension contributions, no legal tactic left untested,

voters delivered another kind of message to politicians last week.

After 26 years as San Bernardino city attorney, James Penman, was recalled

by 60 percent of the vote along with Councilwoman Wendy McCammack. Another

recall target, Councilman John Valdivia, survived the challenge.

Penman twice ran against Morris for mayor and lost. The clash between

factions led by Morris and Penman, said by his critics to be too close to labor,

is often cited when the San Bernardino political culture is called

gdysfunctionalh or gtoxic.h

Morris, who did not run for re-election, is one of the three Democratic

mayors who joined San Jose Mayor Chuck Reedfs drive for a pension reform

initiative opposed by a labor coalition. Penman was replaced by Gary Saenz.

McCammack was recalled by 58 percent of the vote (1,256) in her council

ward. But she was the leader among 10 candidates for mayor (24 percent or 3,043

votes) and will be in a Feb. 5 runoff with Carey Davis, endorsed by Morris and

the Sun.

Two weeks before the election, Councilman Robert Jenkins was charged with

harassing an ex-boyfriend and Councilman Chas Kelley was charged with perjury

about campaign funds. Kelley resigned. Jenkins was defeated last week by Benito

Barrios.

What impact the outcome of the election might have on the course of the

bankruptcy remains to be seen. One of the recent issues debated by the council

is whether costs could be cut by contracting with another government agency for

fire services.

Councilman Fred Shorett, now facing a runoff against Anthony Jones, made

several unsuccessful attempts, backed by Morris, to get the city council to ask

the city manager to solicit bids for city fire services.

At a council meeting Oct. 7, Penman said an earlier request found that

providing police services through the San Bernardino County Sherifffs department

would cost more and put fewer officers on the street.

gThis was especially true because the conversion factor from our pension

system, the CalPERS system, to the county system for the sheriff would result in

an adjustment we were going to have to pay of several million dollars,h Penman

said. gThe same would be true if we were to contract with San Bernardino County

Fire.h

In a sketchy plan last fall for operating in bankruptcy, San Bernardino

proposed a gfresh starth that would greamortize CalPERS liability over 30

years,h perhaps in a way that would grealize value of $1.3 million per year

starting fiscal year 2014.h

Among the unanswered questions now: Did the city make a more detailed or

different proposal for cutting pension debt in the confidential term sheet last

month? Will the election result in a new city direction on pension debt?

As was pointed out in the Stockton bankruptcy, CalPERS is only the manager

of the city pension funds, a gconduith or gpass-throughh agency. The pension

debt is owed to employees and retirees, who presumably would take the hit if the

debt is reduced.

The latest valuation of the San Bernardino pension funds, as of June 30,

2011, shows employer contribution rates for this fiscal year that are not

unusually high: safety (police and fire) 31.5 percent of pay and miscellaneous

18.2 percent of pay.

The funding levels are near the CalPERS norm. Using market value assets, the

safety plan is 74 percent funded with a debt or gunfunded liabilityh of $152.6

million. Using actuarial value assets, safety is 83 percent funded with a debt

of $99.7 million.

In the view of some, what makes San Bernardino unusual, though CalPERS

apparently disagrees, is the ability to pay.

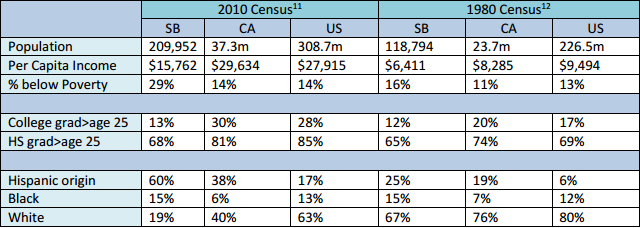

A George Mason University case

study of the bankruptcy said San Bernardino is the gpoorest city of it

size in the state,h with nearly a third of the 210,000 residents below the

national poverty line.

But the city charter automatically links pay for police and firefighters in

San Bernardino, which has a median household income of $35,111, to 10 other

cities that have an average median household income of $62,118.

In the last three decades, said the study, San Bernardino was bypassed by

the I-15 Interstate and three major employers closed: Kaiser Steel, Santa Fe

Rail Yard and Norton Air Force Base.

Three remaining large employers do not pay property taxes: CSU San

Bernardino, San Bernardino Community College and San Bernardino County. State

actions have shifted redevelopment funds and vehicle license fees.

gAs an unfortunate consequence of politics and historical trends, the city

found itself committed to salaries and pensions that were neither proportionate

nor sustainable,h said the George Mason study by Frank Shafroth and Mike

Lawson.

San Bernardino change during three decades (George Mason graph)

Reporter Ed Mendel covered the Capitol in Sacramento for nearly three

decades, most recently for the San Diego Union-Tribune. More stories are at

Calpensions.com. Posted 12 Nov 13